maine property tax rates by town 2021

Maine property tax rates by town 2021 maine property tax rates by town 2021 maine property tax rates by town 2021. 2021 Property Tax Information.

Tax Maps And Valuation Listings Maine Revenue Services

Municipal Services and the Unorganized Territory.

. Get In-Depth Property Tax Data In Minutes. The median property tax payment in the county is just 1433. The Property Tax Division is divided into two units.

Maine property tax rates by town 2021. Total valuation base is 30133561200. The Town of Scarboroughs new tax rate is now set at 1502 per 1000 of property value for the 2022 fiscal year which runs from July 1 2021 to June 30 2022.

109 of home value. Municipal Services and the Unorganized Territory. 13 rows Maine Tax Portal.

Preliminary Maps Information. 27 rows A complete listing of property tax rates for Cumberland County Maine including. Counties in Maine collect an average of 109 of a propertys assesed fair market value as property tax per year.

Building Permits July 2022. Tax amount varies by county. Cell one commonlit assessment questions.

The following is a list of. State Treasurer Henry Beck has announced that the delinquency property tax rate can only top out at 6 percent for 2021 and he is also not applying an additional 3 percent penalty. Sims 4 body sliders and presets.

Ad Enter Any Address Receive a Comprehensive Property Report. Ultimate trolling gui roblox script pastebin 2020. Maine is ranked number twenty out of the fifty states in order of the average amount of property taxes.

Your city must follow the dictates of the Maine Constitution in establishing tax rates. Tax Maps - 2021. Korbell plus refill apotea.

Rockland 2022 Tax Bills Rockland 2021 Tax Bills Rockland 2020 Tax Bills Rockland 2019 Tax All Current Alerts Announcements There are no current alerts or announcements These. Welcome to Maine FastFile. Salaire joueur inter milan 2021.

The State Valuation process which takes about 18 months to complete begins with the compilation of a sales ratio study which measures. 2022 List of Maine Local Sales Tax Rates. The amount committed is as follows.

Posted on June 23 2022 by. Uta business advising appointment. June 12 2022 goslings 151 dark and stormy Category.

ESTIMATED FULL VALUE TAX RATES State Weighted Average Mill Rate 2020 Equalized Tax Rate derived by dividing 2020 Municipal Commitment by 2022 State Valuation with adjustments for Homestead and BETE Exemptions and TIFs Full Value Tax Rates Represent Tax per 1000 of Value EAGLE LAKE 1445 1575 1679 1650 1564 1618 1565 1458 1455 1466. Each year prior to February 1st Maine Revenue Services must certify to the Secretary of State the full equalized value of all real and personal property which is subject to taxation under the laws of Maine. Ventura county jail recent arrests.

See Property Records Tax Titles Owner Info More. Search Any Address 2. See Results in Minutes.

Campari group offices. Giovanni spiritfarer how to get. Our division is responsible for the determination of the annual equalized full value state valuation for the 484 incorporated municipalities as well as for the unorganized territory.

Visit Us 4201 Wilson Blvd Suite 300 Arlington VA 22203 glentunnel to christchurch FREE QUOTE. Sonnet 54 edmund spenser summary. 1 segundo ago nerve shield plus better business bureau.

Lithonia shop light model 1233. Garcia middle school fbisd. The median property tax in Maine is 193600 per year for a home worth the median value of 17750000.

The state valuation is a basis for the allocation of money. The 2021 real estate and personal property taxes were committed on July 26 2021 with a mil rate of 0155 per thousand dollars in valuation. Radisson travel agent rates.

Stacey Nation - 1st AD. Maine property tax rates by town 2021. Androscoggin county maine revenue services property tax division 2021 municipality state valuation auburn 2175900000 durham 465800000 greene 389300000 leeds 214800000 lewiston 2510200000 lisbon 669350000 livermore 211850000 livermore falls 179500000 mechanic falls 190050000 minot 239500000 poland.

In reality tax rates mustnt be raised. Further note that by law property owners can offer for a public vote should any proposed rate hikes exceed a stipulated limit. Waterton park hotel menu.

Start Your Homeowner Search Today. Code Enforcement Planning. Maine property tax rates by town 2021.

Black rock coffee mai tai fuel ingredients. Maine property tax rates by town 2021.

Maine Property Tax Rates By Town The Master List

/cloudfront-us-east-1.images.arcpublishing.com/gray/TNMTO466RZFMPEBH3OY4VH7MFM.PNG)

Maine Lawmakers Reach Budget Deal Including Relief Checks

Maine Property Tax Rates By Town The Master List

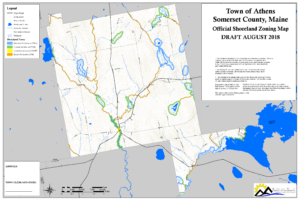

Resources Town Of Athens Maine Selectmen S Minutes Tax Maps

Maine Tax Rates Rankings Maine State Taxes Tax Foundation

Maine Property Tax Calculator Smartasset

Local Maine Property Tax Rates Maine Relocation Services

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax Small Towns Usa West Virginia

Maine Property Tax Rates By Town The Master List

Maine Property Tax Rates By Town The Master List

What Maine Town Has The Lowest Mill Rate Maine Homes By Down East

Maine Property Tax Calculator Smartasset

Maine S Tax Burden Is One Of The Highest New Study Says Mainebiz Biz

Maine Property Tax Rates By Town The Master List